MIAB’s “professional service” and “excellent communication” has ensured Mr Allen Brown at Portrush Medical Centre has stayed a loyal customer for the past six years!

Initially taking out Locum Insurance, Mr Brown has also switched their Surgery Insurance to MIAB.

Mr Brown said he initially chose MIAB “due to the competitive price, and the level of cover was better [than other providers]. We felt like MIAB didn’t pressurise us. We were presented the policy that they felt was best and [they] let you make your own decision, which I really liked. The service has kept us renewing every year as competitors do not provide the same level of service.”

Portrush Medical Centre has made two claims, one for paternity, and one for sickness. In regards to the paternity claim, Mr Brown said “it was very straightforward, everything was explained in detail over the phone and clarified again via email so we were completely clear with what was happening. We were kept up to date throughout the entire process and knew exactly where we stood at each stage.”

Did you know?

Two weeks of paternity leave by a GP can cost a practice up to £5,000 for Locum cover, and unfortunately the NHS Sickness Reimbursement Scheme does not cover it as it is dealt with elsewhere in the SFE. An insurance-backed contract can provide practices with financial security when staff take paternity/adoption leave.

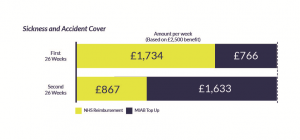

Should a practice need to claim for GP sickness or accident, the NHS Sickness Reimbursement Scheme could cover it. However it may not pay the full amount required to cover the GP’s sessions. MIAB has designed a ‘Top-Up’ Scheme to wrap-around the NHS Reimbursement and benefit you in the event of a sickness or accident related claim.

MIAB’s “professional service” and “excellent communication” has ensured Mr Allen Brown at Portrush Medical Centre has stayed a loyal customer for the past six years!