Locum Insurance provides cover when accident, sickness or absence affects your business.

Protect your business

Get a quote Book an Appointment

With so much pressure on staff, any absence can have a major effect. A clinician, partner or senior member of staff away for a few days or a week or two may be covered internally. However, if they were absent for several months, how would the business cover their sessions?

Any staff absence within your practice can have a major effect.

Our staff absence calculator below will help you to understand the potential financial impact on your business if a key member of staff is absent for a sustained period.

Simply insert the figures relevant to your own situation in our calculator below to find out what locum cover is costing you:

Locum Calculator

Locum Insurance

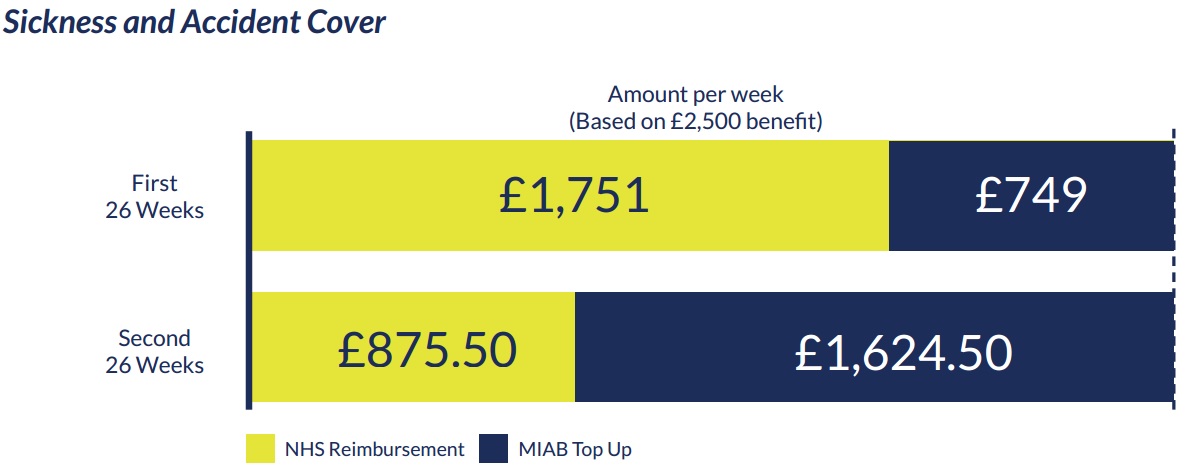

Aimed at GP practices, Locum Insurance is designed to quickly and easily cover the cost of hiring a Locum to fill GP absences. Our innovative ‘Top Up’ policy blends the benefits of the NHS Sickness Reimbursement and Locum Insurance. Practices can maximise the reimbursement payments for GP sickness and accident absence but rely on Locum Insurance to cover costs over and above the NHS reimbursement.

Our expert advisers will help you choose the most suitable policy.

Whether you are a single-handed practitioner or work in a large, multi-partner practice, we have a policy to suit.

We offer a flexible deferred period (also known as an excess period), which is the time before any benefit is paid. The longer the period, the lower the premium.