Protect your business with Locum Insurance

With so much pressure on staff, any absence can have a major effect. Up to a few weeks may be covered internally, but how would the business cover sessions if a GP’s absence stretched over a period of months?

Locum Insurance is aimed at GP practices, and is designed to quickly and easily cover the cost of hiring a Locum to fill GP absences.

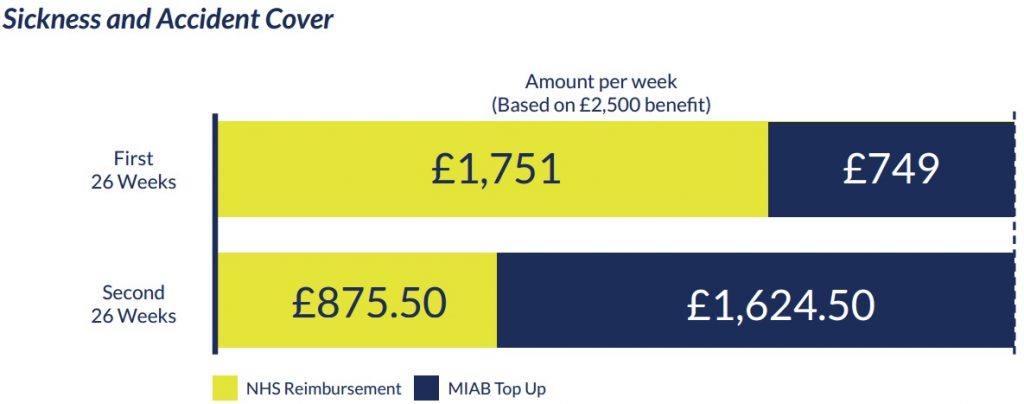

Our innovative ‘Top Up’ policy blends the benefits of the NHS Sickness Reimbursement and Locum Insurance.

Practices can maximise the reimbursement payments for GP sickness and accident but rely on Locum Insurance to cover costs over and above the £1,751 per week reimbursement.

Cover for your practice and reassurance for you with our Surgery Insurance

Running a GP practice is unlike most other businesses, with a unique set of challenges. We’ve designed a Surgery Insurance policy to cover a range of risk, such as:

- Medical

- Commercial

- Staff

- Liability

- Equipment

As experts in medical insurance, our Specialist Insurance Advisers are on hand to answer your questions and discuss the most appropriate policy for your needs.

Malpractice cover for you, your business and your employees with our Indemnity Insurance

You’ve worked hard to get to where you are and, in an age of easy-access litigation (or threat of litigation), you want to take steps to avoid the immense costs involved in defending a legal action. Without medical malpractice insurance, you run the risk of being exposed to many liabilities, such as:

- Misdiagnosis

- Neglect

- Bodily Injury

- Mental Injury

- Duty of Care

- Error or Omission

- Good Samaritan Acts

With Professional Indemnity costs soaring, getting value for money is crucial. We offer a range of personal and commercial indemnity and liability insurance products to cover the costs of various actions:

Professional Indemnity Insurance

The policy covers the cost of compensating clients and service users for loss or damage resulting from negligent services or advice provided.

Pharmacists in General Practice Indemnity

It provides appropriate levels of cover for all duties and activities undertaken by Senior Clinical Pharmacists and Clinical Pharmacists.

Management Liability

Employment Practices Liability

It entitles you to expert legal help in the event of an investigation or claim made against you, and more.

Cyber Liability and Data Insurance

This policy covers the losses relating to damage to, or loss of information from, IT systems and networks, and is a must-have protection.

Personal Protection – covering your family

When was the last time you reviewed your personal protection policies, like Private Medical Insurance? Circumstances change but your policies may not reflect them. Let MIAB take a look and see how quotes compare.

MIAB also offer Home, Contents and Travel Insurance to match your lifestyle, and Landlords Insurance to cover your property investments.

Contact us to find out how we can add value to your practice and personal protection.

Contact Us